Investing on behalf of your children can give them a great financial head start in life. And the earlier you can begin, the higher the potential financial rewards for them in the longer term.

The combination of regular ongoing contributions and compounding investment returns can add up to a decent chunk of money for buying a first car, funding a university gap year, or even a sizeable first-home deposit down the track.

But where should you start off, and what are the things you need to consider?

Create a plan

Before doing anything, you need to make sure you have a realistic investment plan.

Which is all about deciding what makes the most sense in terms of your family’s overall financial budget.

That includes determining what you can afford to invest initially, and how much you can afford to contribute on an ongoing basis.

For example, you may have $1,000 to invest as a starting amount and can afford to make additional contributions of $100 a month or quarter.

While your financial circumstances are likely to change over time, it’s important to at least have mapped out a strategy that makes sense financially and that ideally can be followed for years.

That will give your children the best chance for long-term investment success.

Decide on how

Investing for children can be done on their behalf using a minor’s account where the investment is held in an adult’s name as trustee (and the child is listed as a beneficiary).

Parents will essentially be custodians for the investments until the child turns 18. They can then be transferred from the parent across to their adult child.

It may be worth seeking some professional advice on what structure will work best for your family, especially in regard to ongoing tax on income and future capital gains tax.

Unless a tax file number is quoted, pay as you go (PAYG) tax will be withheld at 47 per cent from the unfranked amount of any dividend income earned.

Also keep in mind that if a minor owns shares and currently earns more than $416 a year, a parent must lodge a tax return on their behalf.

Choose a strategy

Just like adults, there are different ways to invest for children.

Again, it comes down to what you can afford to invest together with your investment time horizon.

For a longer-term strategy, you could consider a low-cost managed fund that invests in the share market.

That’s because, when you’re looking at investing over a long-term period, you could say that children have time on their side.

The share market is prone to short-term volatility. Yet, over the longer term, it has delivered strong growth. For a child investor, what happens in the short term will have little bearing on their long-term returns.

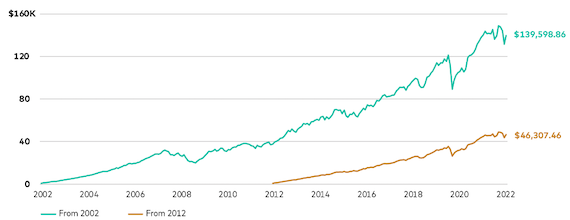

Below is a chart showing the past 20 years of performance from the Vanguard Australian Shares Index Fund.

This is a professionally managed fund that invests in the biggest 300 companies listed on the Australian share market.

Growth of Australian shares with $250 monthly contributions

Source: Vanguard

In effect, the chart is a financial simulation that could be applied to a hypothetical child born in mid-2002 who would have turned 20 in June of this year.

It assumes a $500 investment was made at the time of birth, that all fund distributions were reinvested, and that this child’s parents could afford to continue investing $250 per month for 20 years. The returns are after management fees but before tax.

After 20 years, and including $60,000 of total investments, the balance had grown by approximately $80,000 to a total of almost $140,000.

But let’s say the child’s parents didn’t start investing for them until they were 10 years old, in 2012.

Also starting off with $500 and making ongoing investments of the same amount, the investment balance would have reached just over $46,000 by mid-2022.

That includes $30,000 of contributions made over 10 years and growth of approximately $16,000.

This underscores the benefit of starting off a child’s investment plan as early as possible.

Of course, beyond managed funds, there are other ways to invest for children that have more exposure to lower-risk investments such as bonds and cash.

Among these, think of a managed bond fund, a child’s bank savings account or a term deposit.

These can be appropriate for short-term savings strategies, but keep in mind they typically produce lower average annual returns than the share market over long periods.

Over 20 years, Australian shares have delivered an average annual return of 8.2 per cent versus 4.7 per cent for Australian bonds and 3.6 per cent for cash.

Investment bonds are a longer-term “tax-effective” product, where no tax is payable on earnings if the bond is held for a minimum of 10 years.

They are usually held in an adult’s name, and could be suitable for a child.

But the average annual returns on investment bonds (less than 5 per cent) are also much lower when compared to the long-term growth of the share market.

If you are interested in learning more about investing for your children or an investment strategy just for you, call us on 0415 306 000 today.

Source: Vanguard

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2022 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.